The artist

- No galleries. No intermediaries.

- $74,211 in personal capital funds the installation.

- Unlimited supply.

- The business model is the artwork.

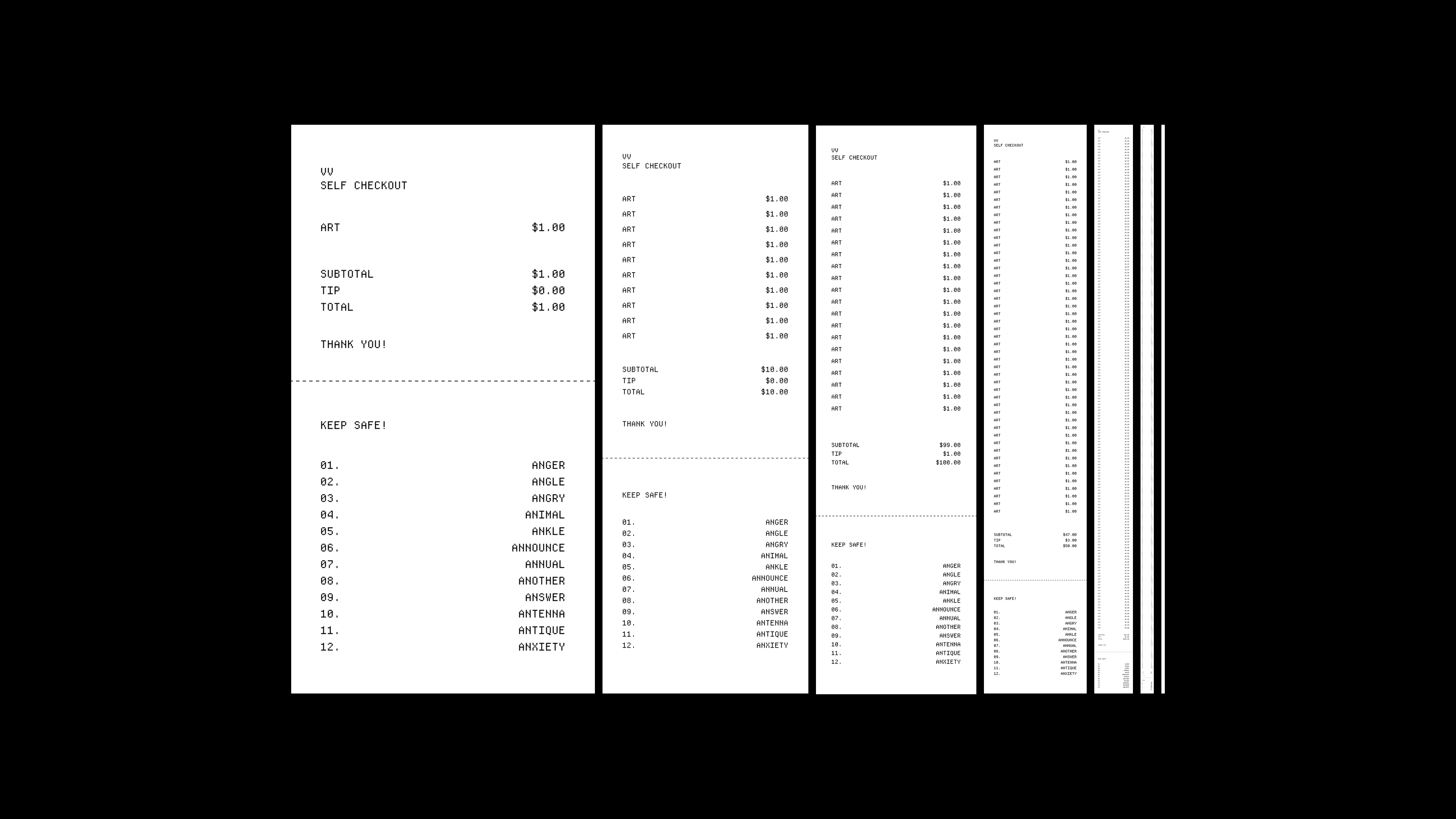

Pay what you want at Art Basel. Your receipt is the artwork. Payment amount equals receipt length. A live display tracks whether the artist recoups $74,211 in production costs or takes a public loss.

01

02

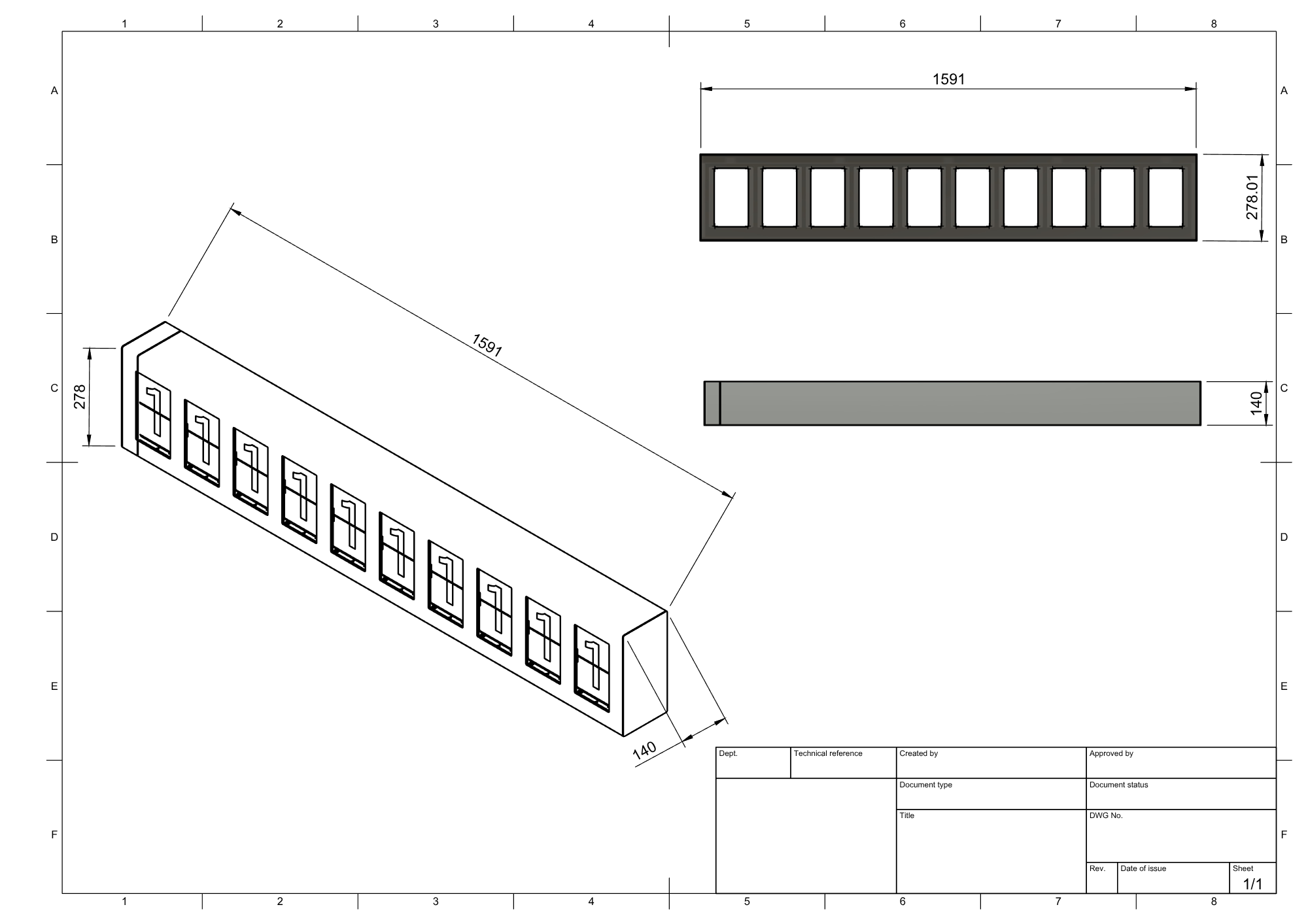

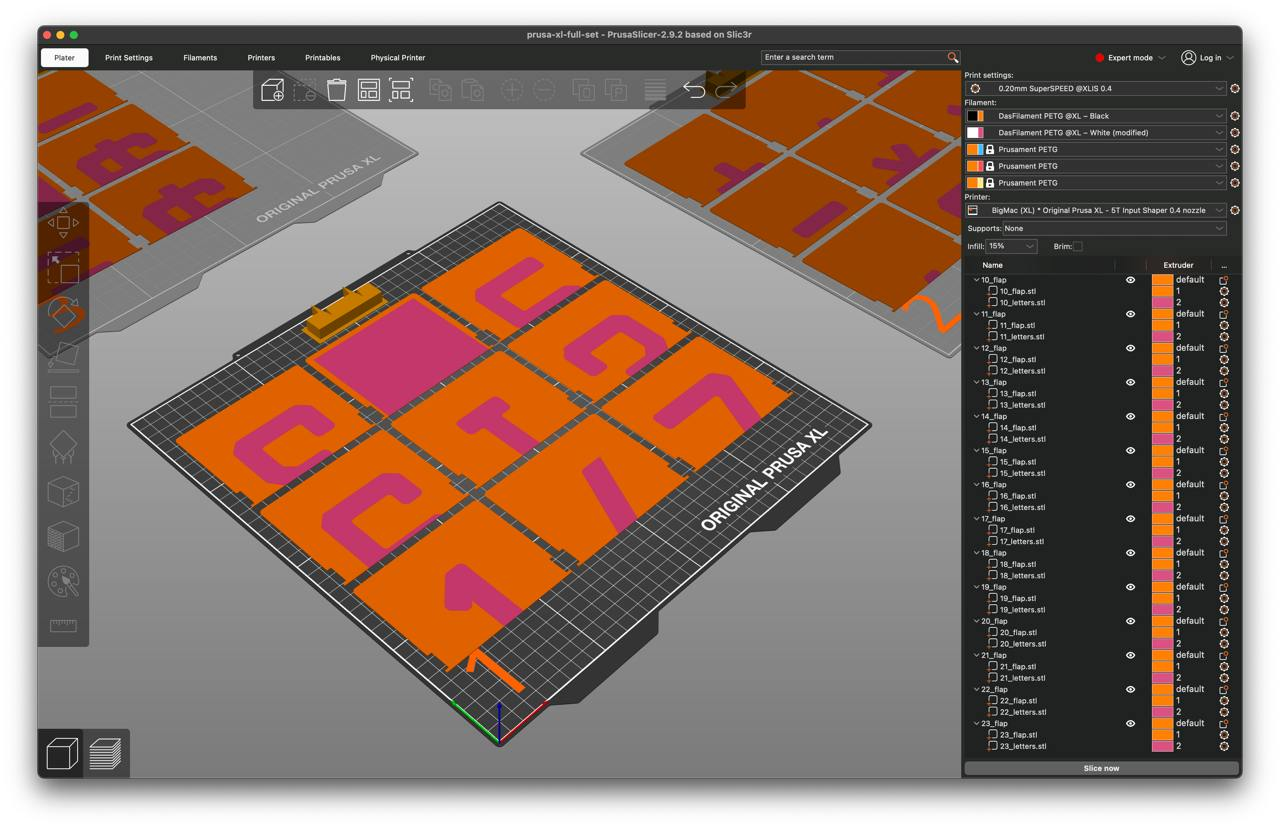

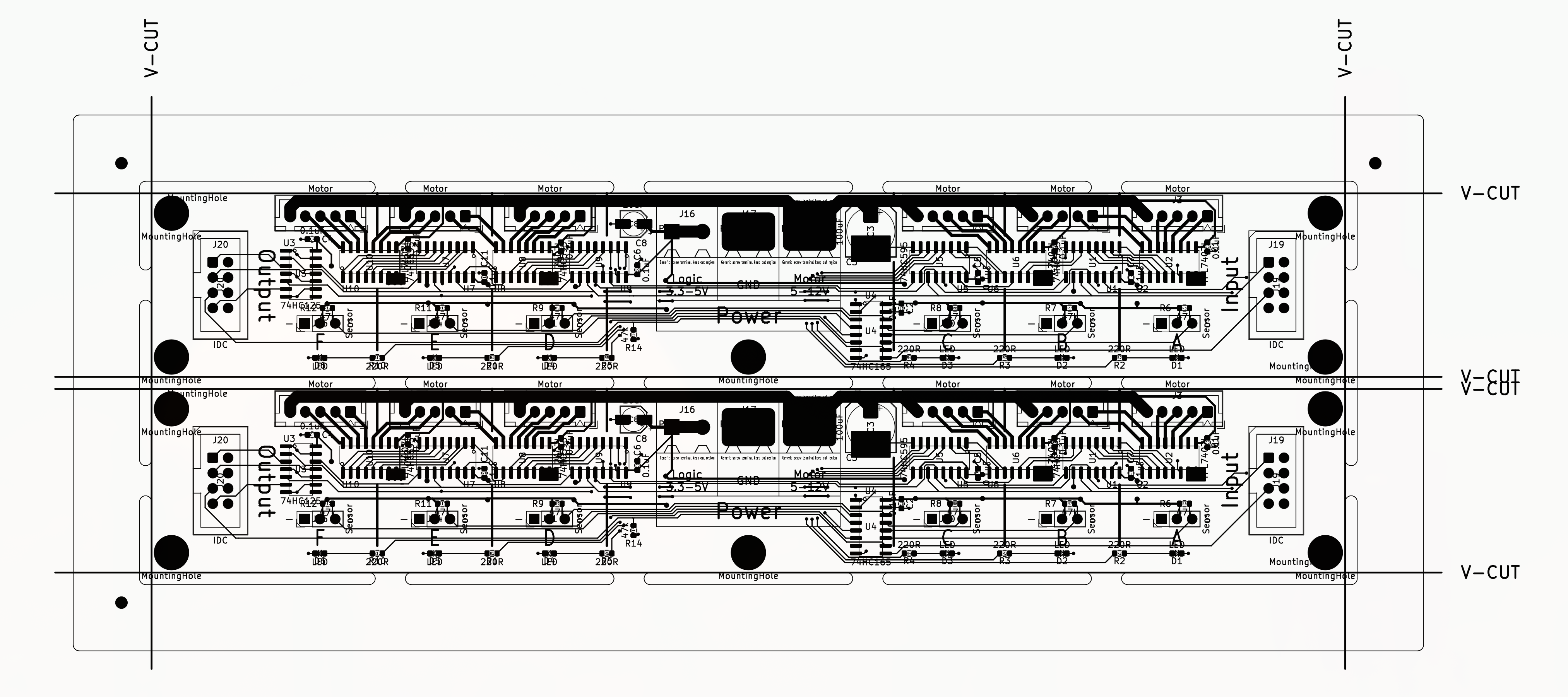

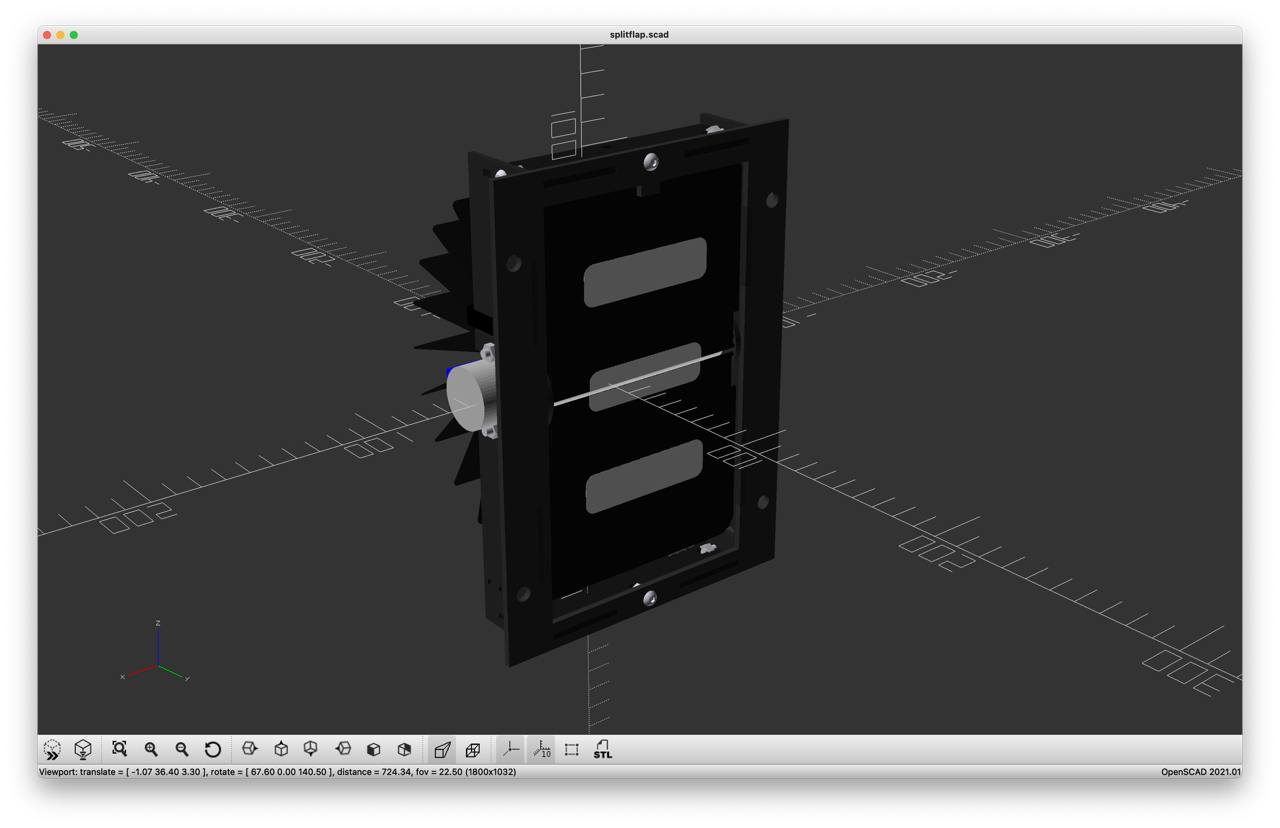

Self Checkout installs retail hardware inside Art Basel. Three kiosks handle in-person transactions while a transparent Online Orders kiosk prints remote purchases in real time. Card, contactless, and browser-based payments live on the same rails. Thermal printers map each dollar to receipt length and stamp a seed phrase that unlocks a non-transferable NFT. Remote buyers pay shipping and receive their receipt in the mail. A split-flap display starts at -$74,211 and broadcasts every movement. The booth is live accounting presented as installation.

03

04

05

Receipts are the object. Galleries hide transaction records. Thermal paper is fragile, temporary, and low-status.

Length is evidence. A five-inch slip and a ten-foot ribbon signal different choices. The material records the decision.

Thermal paper fades. The NFT is immutable. Printing seed phrases on perishables reintroduces custody risk. Trust becomes physical again.

06

The number is unrounded because it is the actual cost: booth fee, fabrication, display, printers, freight, labor, travel. Every component is itemized and broadcast.

Most art hides its economics. Self Checkout leads with the ledger. The stake is visible before payment.

Specificity signals precision and exposure. Seventy-four thousand, two hundred eleven dollars sit on the line without cushioning. The exact number is the vulnerability.

07

The tip function uses service-economy mechanics inside an art fair. The kiosk suggests 15%, 18%, and 20% on each purchase and allows for custom amounts.

08

A parallel no-reserve auction lists the split-flap display (and its final PNL) as a single lot. Collectors can bid in person, and online. Every bid posts to the display, adjusts the balance in real time, and prints its own “PNL BID” receipt. Bidders compete to own the physical scoreboard, the final ledger document, and the signed artist statement.

09

Negative balance documents market failure in real time. The final number plus receipt distribution becomes expensive evidence that transparency wasn't rewarded.

Hitting $0 means the audience collectively valued the experiment exactly at cost. Perfect crowdsourced appraisal and proof of shared responsibility.

Going positive proves alternative pricing can outperform tradition. Basel witnesses a transparent, abundance-based system thriving inside its walls. No back rooms, no gatekeepers, no scarcity theater.

Transparently displaying PNL and issuing payment-linked receipts exposes valuation pressure, social influence, and economic engagement inside the art market—no folklore, only evidence.

10

11

12

Every purchase or tip instantly reduces the loss and prints a receipt whose length is locked to the payment.

PROJECTED LENGTH

9.00 in

PNL

-$74,221

VV

SELF CHECKOUT